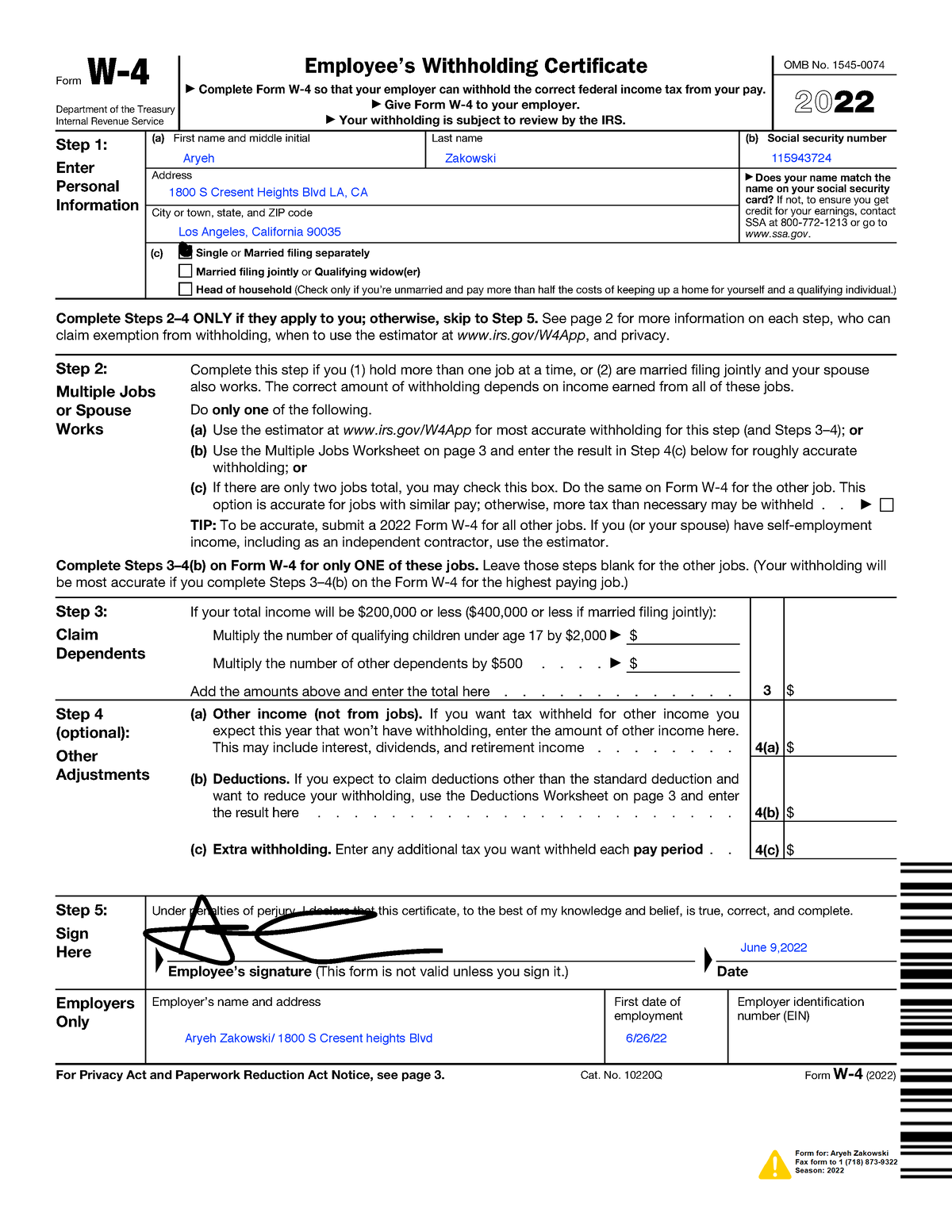

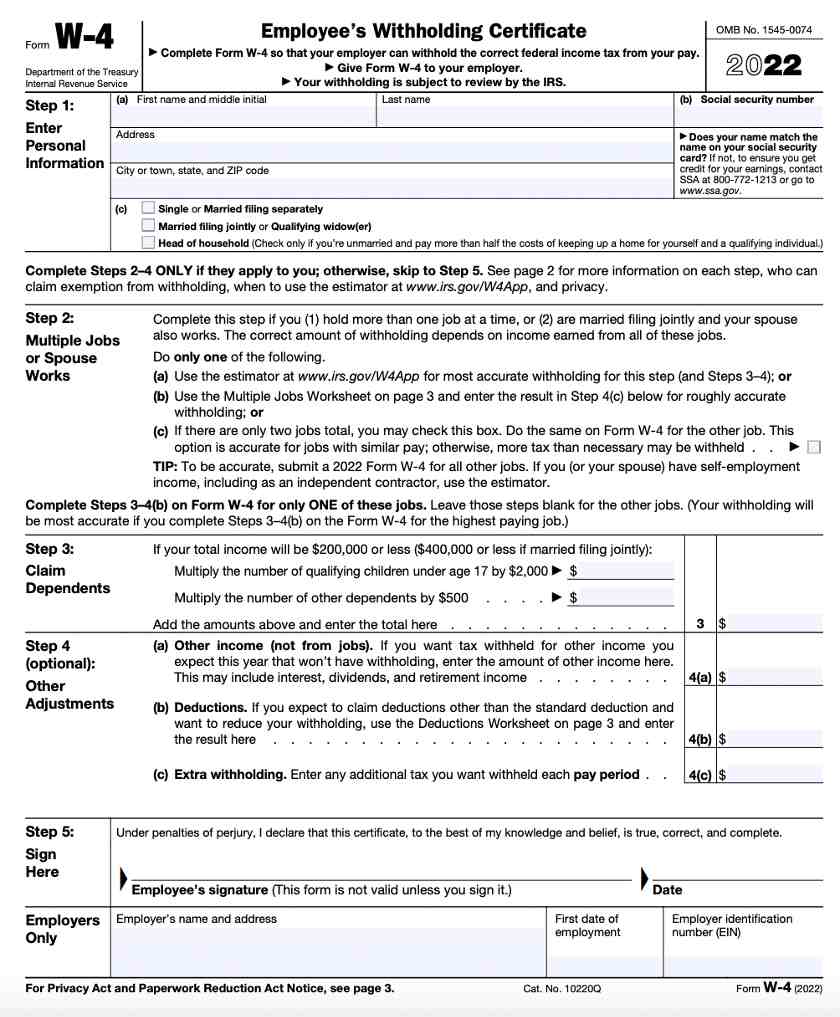

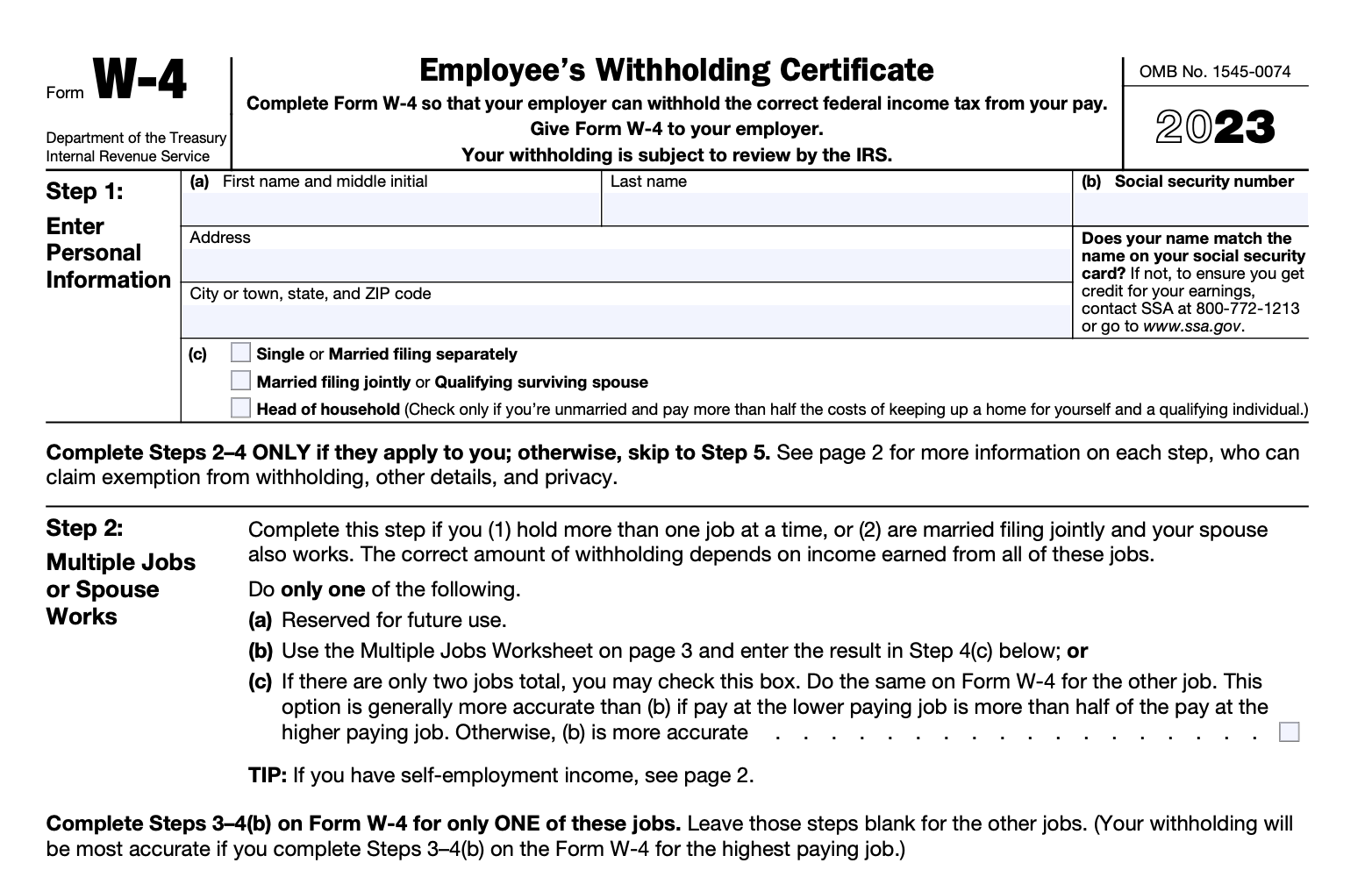

W4 2025 Form. This document tells employers how much federal income tax to withhold from an employee’s pay, meaning workers should adjust. Five to 10 minutes to complete all the questions.

Steps 2(c) and 4(a) ask for information regarding income you received from sources other than the job associated with this.

W4 2025 Suzi Zonnya, On this page, we will post the latest tax information relating 2025 as it is provided by the irs. Salary information for remainder of.

How to Fill Out an IRS W4 Form Money Instructor YouTube, Current paycheck stubs for all jobs. Request for transcript of tax return form.

Form 2025 2025 Schedule E bianca cathrine, Steps 2, 3, and 4 are only completed if certain. Your claim of exempt status may be reviewed by.

Free Printable W 4 Form For Employees Free Templates Printable, You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. Doing so will allow you.

What Is a W4 Form? How to Fill Out an Employee’s Withholding, Employers use the information on. Five to 10 minutes to complete all the questions.

Apply Now DV 2025 How to Submit DV2025 Form DV2025 Official Site, Tax year 2025 seems far into the future. Complete the employee’s tax withholding certificate.

What are 4 C of credit? Leia aqui What do the 4 C’s mean, Fill in the fields using the info from the calculator. You’ll enter that amount on line 4 of the.

2025 Form W4 health Form W Department of the Treasury Internal, Salary information for remainder of. Irs, federal tax forms, schedules for 2025.

The Form W4 indicates the amount of federal tax to be withheld, Fill out the multiple jobs. Fill in the fields using the info from the calculator.